5 Fundraising Mistakes – And How to Avoid Them

What you don’t know—especially about fundraising—can hurt your company. In our earlier post, we discussed alternate options to equity funding, so we’ll assume that you’ve avoided the mistake of overlooking debt as an option for your business. Equity can be a great way to raise money, but non-dilutive financing, or different types of debt, also offer a powerful way to help your company grow. At Hum Capital, we want to help you choose wisely among fundraising alternatives, and that starts by steering you away from these five common fundraising mistakes. Ryan Ridgway, Hum’s VP of Business Development and (previously) a co-founder of several fintech startups, shares his guidance below.

Fundraising Mistake #1:

Going With Just One Lender

It’s easy to see the appeal of focusing on a single lender as you pursue financing. Some people want to work with a specific lender because they’ve had a long-term relationship . Working with only one financier, you only need to prepare one set of documents and build one relationship. But the ease of working with one financing source, no matter how long you’ve known them, comes at a cost—you don’t know if you’re getting the best package. For example, there may be a more suitable financing vehicle for you that this lender doesn’t provide, or a different lender may offer better terms or lower costs on the same solution you’re considering.

Often, people stick with a particular lender because of its strong brand recognition and/or reputation. If you have the option of working with a highly respected lender, such as Silicon Valley Bank, you may be willing to trade a slightly higher interest rate for the brand value and industry knowledge they supply. That said, you still should know what you’re giving up, rather than jumping into a relationship where you’re not fully aware of the costs.

Avoiding Fundraising Mistake #1:

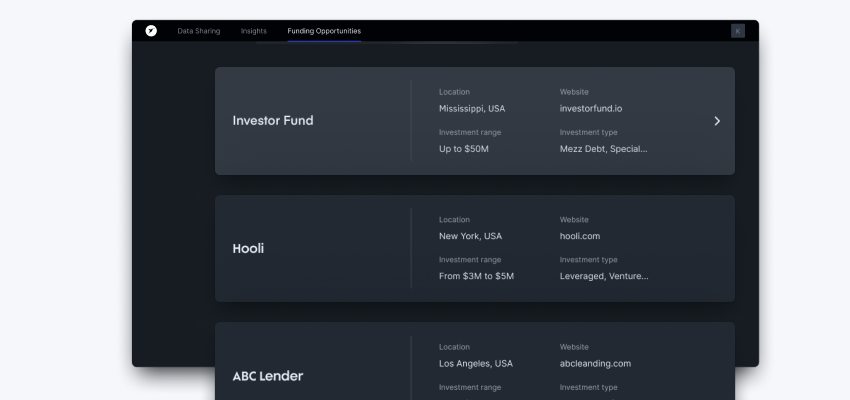

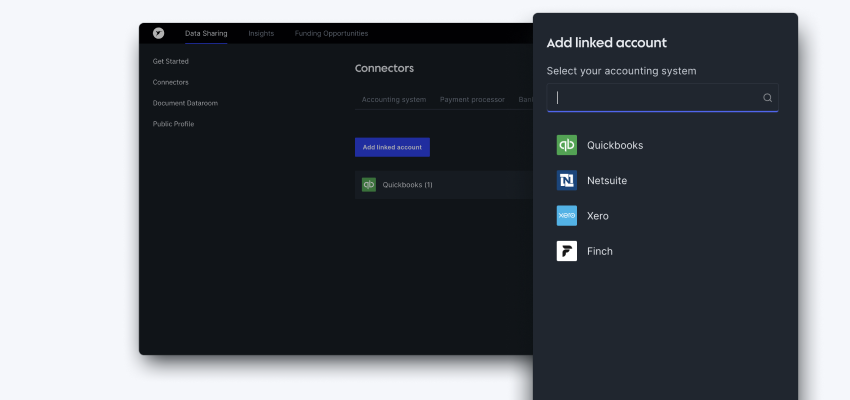

Cast a wide net! Reaching out to multiple potential lenders gives you more optionality. You’ll better understand your options and their pricing, allowing you to make a more informed decision. Shameless plug, but using a platform like Hum’s Intelligent Capital Market (ICM) makes it easier for you to consider different lenders in two ways—the platform consolidates your information for easy submission to multiple lenders, and it allows you to compare their packages presented in a consistent manner.

Fundraising Mistake #2:

Confusing Pre-Approval with a Term Sheet

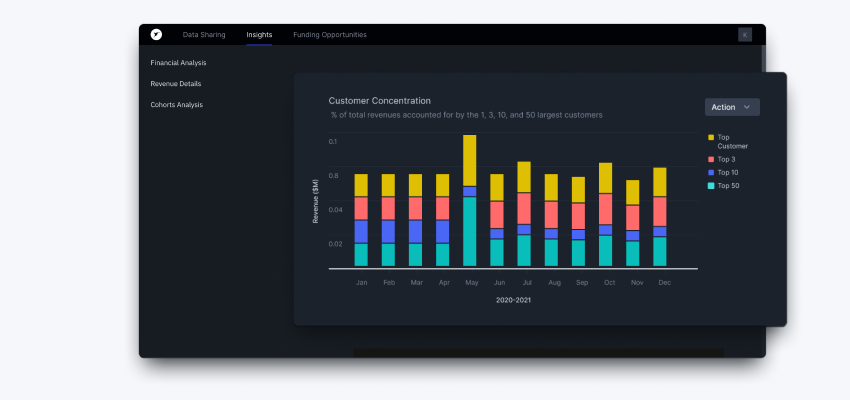

Many lenders, particularly in the small-and medium-business (SMB) environment, promise very fast pre-approval (sometimes confusingly called a term sheet)—often within hours or days. But pre-approval is not full approval! It’s more like an expression of interest in working with you. The pre-approval form merely indicates the general scope of the eventual deal and you should expect the lender to ask you a lot of questions when conducting due diligence. Knowing this simple fact can save you from shock when, after due diligence that takes much longer than hours and days, the lender proposes an actual term sheet that differs significantly from the ranges they initially proposed. You can’t get a real term sheet without supplying a lot of information about your company’s performance, ranging from cumulative revenue, expenses, churn, and customer acquisition costs, to revenue by cohort and so forth. Don’t believe anyone who says they’ll give you a loan within a few hours.

Avoiding Fundraising Mistake #2:

Start your financing journey with a comprehensive understanding of your business, its current metrics, and how they’re growing. You can compile these and keep them in an Excel spreadsheet. Here at Hum, our ICM platform maintains data for more than 2,300 companies and runs a variety of analytics to help you better understand your business and its growth path, so you can see your business as a capital provider might evaluate it. With more than 250 pre-qualified investors on our platform, we help you prepare for conversations with the appropriate potential partners. You’ll be able to track your process with each investor you’ve engaged, rather than wondering if your account officer has lost your file. Because we have everything organized upfront, the process tends to move more quickly and smoothly.

Fundraising Mistake #3:

Paying a Big Broker Fee Upfront

It’s tempting to hire a broker when you’re embarking on a new enterprise like fundraising. But this comfort can come at a major cost as some small business finance brokers request a substantial fee upfront. Unsurprisingly that practice is prevalent in the sub-prime area, where founders are desperate for money and the product will likely be high-cost and high-risk, but it’s not unusual even with conventional lending situations. If you’re raising less than $50 million, these fees are typically several tens of thousands of dollars, but can reach $100,000. Requiring an initial fee is not an indicator of the broker’s quality—but in many cases, you can avoid these fees by using a different financial product or working with a different provider.

Avoiding Fundraising Mistake #3:

Again, working with multiple providers (remember mistake #1!) helps you understand if an initial fee is customary with your type of deal. If it is, you can find the best offer. If it’s not, you can either suggest the original lender reconsider the fee, or choose to work with someone else. Here at Hum, we get paid a small transaction fee based only on the deals we successfully help you close on our platform. If we don’t help you close a good deal, we don’t get compensated. Because our interests are aligned with yours, we’re eager to connect you with the best financing options and to close the transaction efficiently.

Fundraising Mistake #4:

Trying to Go it Alone

As a founder, you may feel that everything weighs on your shoulders, including fundraising. Fundraising is a big undertaking and requires assembling a large amount of information, often under time pressure. It may push you outside your comfort zone, requiring that you create a pro-forma, estimate future revenues and headcount, and calculate churn and the long-term value of a customer. And you must do all this while also running a company. It’s easy to feel that just putting the paperwork together to go down to your local bank and take whatever they will give you is sufficient. But this fundraising mistake ignores two important facts: first, finding options is not as difficult as it once was, and second, help is easy to find.

Avoiding Fundraising Mistake #4:

This is the year 2021. While you’re on hold with a vendor, you can run a search and find out which lenders target your sector. Should you look into venture debt? Revenue-based financing? (See our post explaining non-dilutive funding options.) For any type of financing, you need to assemble and analyze information. If your CFO or accountant can’t assemble it, you should get a new CFO or accountant. Then send the material to the firms that look like a good match. To make it easier, we at Hum developed the ICM to do the heavy lifting for you. You can fill in your data and our engines do the number crunching. Inputting your company’s data onto our platform takes less than 5 minutes if your financial reports are up-to-date and accurate. We can then recommend the right financial product for a company in your sector, at your stage of development, and with your needs. The lenders on the platform have listed their investment theses and underwriting criteria, so we’re matching you with appropriate financing partners. Of course there’s a fee for it depending on a lot of details such as if you’re pursuing debt or equity capital, but you only pay if your deal closes. So you have a trusted advisor with aligned incentives. You don’t have to go it alone. You wouldn’t use a platform like Hum Capital’s if you wanted to do a completely confidential fundraise, or if your company was so unique that our network didn’t include the proper specialized funding firms. Additionally, if you have a super-experienced CFO who’s totally plugged into the financing options, you most likely don’t need a service like ours. But if that’s the case, you’re probably not reading this blog post!

Fundraising Mistake #5:

Working with Funders for Just One Phase of Growth

One thing you should consider in your fundraising is whether your lender can grow with you. Young companies that haven’t reached cash flow break-even may need to finance themselves through revenue-based financing (RBF) or factoring. As a company grows and becomes profitable, it can use alternatives like senior lending facilities that have a lower cost of capital. But making that transition can be difficult if you don’t have the right financing partner. A lender with limited offerings is unlikely to suggest options it can’t provide. And because you’ve been focused on growing your company, you haven’t had time to research alternative financing vehicles. So you could be stuck with certain funding methods long after they’re the best fit for you.

Avoiding Fundraising Mistake #5:

There are a few ways to avoid this error. Certainly, a great CFO or a good accountant will stay on the lookout for better financing options. If you connect your systems to Hum’s ICM platform for your first funding and keep that connection current, we can suggest more appropriate financing options as your company grows.

Summary

There are, of course, an almost infinite number of mistakes one can make in financing your company, but these are the five we’ve seen—and helped fix—most often. We hope this list has given you some food for thought. If nothing else, take away the idea that you should never, ever pursue only one financial option. Knowing your options is strength. Making a clear, considered decision where you trade off brand name and terms and extent of product offerings is a critical part of setting your company up for long-term success.

If you’re intrigued by the benefits of Hum Capital’s ICM, please sign up for a free Intelligent Capital Market account today. We’d love to match your company with the best lending package and lender.