How Hum's platform works

Securing funding through Hum Capital is a seamless and efficient process. Hum collaborates with companies seeking $1-$50M, spanning diverse sectors and growth stages, with annualized revenue exceeding $2 million and a runway of more than six months.

Investment range

Investors on the ICM

Companies on the ICM

$1-50M deal size focus

At Hum, we bring our significant expertise to transactions ranging from $1 to $50 million. Across all sectors and regions of the US, we excel in facilitating fundraising for companies, ensuring they secure the financing they need to thrive.

Extensive Distribution Network

Our robust distribution network spans over 500 lenders, encompassing both banks and non-banks. This extensive reach enables us to evaluate the perfect financing solution for our clients, regardless of industry or stage of development, whether they are venture-funded startups or bootstrapped enterprises.

Streamlined Process Management

Hum prides itself on an efficient process management system designed to streamline transactions. Our tech-accelerated approach not only improves terms and expedites the time to term sheet but also involves managing multi-lender negotiations to secure the best offers. With Hum, expect term sheets in as little as 3-5 weeks, and we value your time, often spending less than an hour with interested lenders before securing term sheets.

Trusted Long-Term Credit Partner

As your long-term credit partner, Hum is committed to meeting your evolving credit needs. We've raised multiple rounds of financing for our clients, establishing enduring relationships built on trust and expertise. Whether it's bilateral deals or syndicated transactions, we have the experience and dedication to support you throughout your journey.

TRUSTED BY OVER 6,000 COMPANIES

What to expect

When fundraising through Hum Capital, expect streamlined processes and personalized guidance tailored to your company's needs.

Data Sharing

Connections to financial systems of record

Seamlessly integrate your financial systems with the ICM for effortless data updates and analysis. Connect directly to platforms like Quickbooks, NetSuite, and Plaid, ensuring lenders have fewer items to share on an ad-hoc basis.

Security and privacy

Hum uses banking-industry standard security policies (SOC2 certified) to keep your data safe and secure.

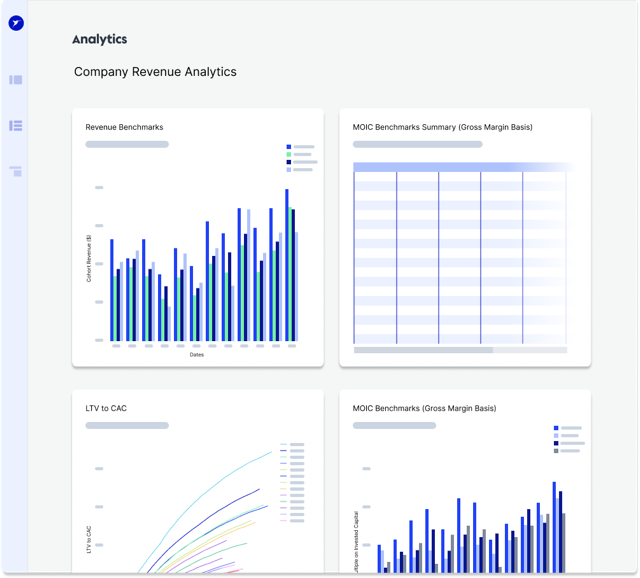

Insights & Analytics

AI-powered analytics

Hum employs AI-powered analytics to swiftly evaluate companies, providing feedback in as little as 24 hours. Our machine learning algorithms organize, label, and analyze your performance data, offering insights such as customer cohort analyses, LTV to CAC ratios, and cumulative revenue and expenses, among others. Once evaluated, we work closely with companies to run a seamless and expedited fundraising process.

The Fundraising Process

Customers may choose one of two paths with us:

- Access debt capital directly from our captive fund

- Access debt capital from the market including our captive fund

Regardless of lender, Hum’s team and technology prepares your company for the fundraising process and advocates on behalf of your business through management meetings, term sheet evaluation, and due diligence to secure funding that best suits to your company’s vision.

In addition to assisting companies fundraising from scratch, Hum also works with companies that have already secured term sheets and are looking for to leverage Hum’s technology and expertise for further fund raising advocacy.

Types of Funding

Hum facilitates a range of financing solutions for companies, including but not limited to:

- Revenue Based Financing – for businesses with high margin recurring revenue

- Venture Debt – for businesses with brand name venture capital backing

- Cash Flow Lending – for businesses with at least two quarters of $500K+ EBITDA

- Asset Based Lending – for businesses with inventory, equipment, real estate or receivables

- Specialty Financing – for businesses (i.e. lenders) who offer financial products to their clients

- Bridge Financing – for businesses with a short term, time sensitive financing need

Use of Proceeds

Companies leverage financing for growth, working capital, acquisitions, refinancing and more.