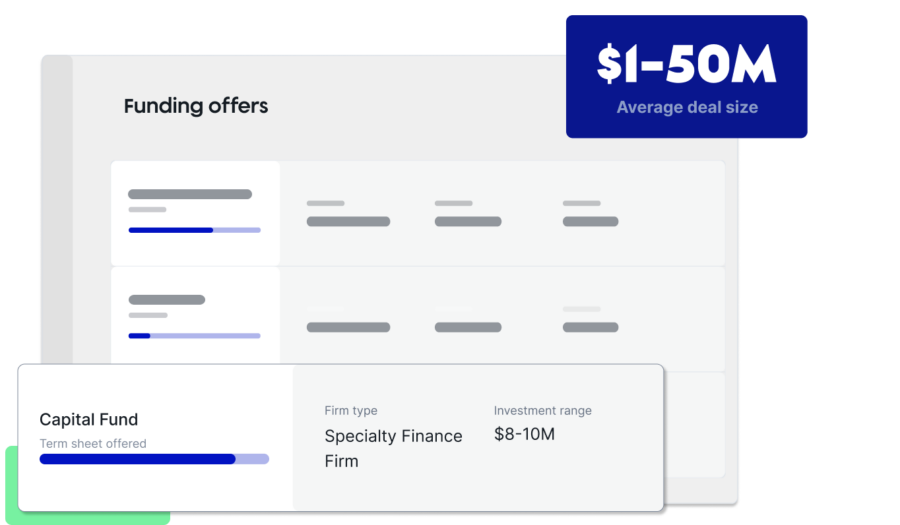

Raise $1M - $50M in Non-Dilutive Capital

Hum Capital is the funding platform connecting great companies with the right capital.

Capital Deployed via Hum

Companies on Platform

Investors on Platform

BACKED BY

Hum Capital’s

Intelligent Marketplace

Hum’s Intelligent Marketplace is an AI-powered funding platform that connects companies with investors and lenders, alongside Hum’s own direct non-dilutive financing offerings.

Access Non-Dilutive Funding Faster

Raise Capital With No DilutionAccess direct non-dilutive financing from Hum and introductions to qualified capital partners.

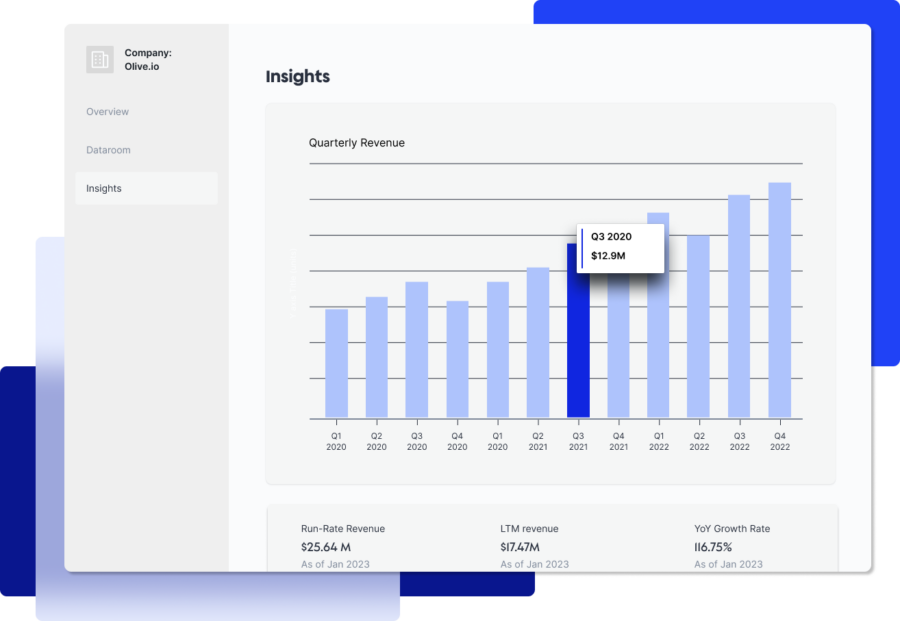

Connect Your Business & Generate Financial InsightsLeverage AI-driven analytics to position your company for both Hum-provided funding and marketplace capital.

Secure Capital Introductions From a Network of 900+ LendersTap into Hum’s intelligent marketplace and institutional capital network.

Quickly Qualify For Working CapitalReceive rapid eligibility assessments for direct Hum financing and third-party funding options.

Unlock AI Powered Deal Flow & Investment Insights

- Receive Targeted Deal Flow

- Leverage Accelerated Screening & Underwriting

- Access AI-Powered Insights & Monitoring