Hum-an Stories: Q&A with Head of Advanced Analytics & Co-Founder Blair Silverberg

This interview is part of Hum-an Stories, a Q&A series with Hum Capital leadership and team providing a look under the hood at what drives Hum and its funding platform, the Intelligent Marketplace.

Blair Silverberg is Hum’s Co-Founder and former CEO, now serving as Head of Advanced Analytics at Hum. Prior to founding Hum, Blair was an investor at Draper Fisher Jurvetson (DFJ), where he evaluated and structured investments in early and growth-stage companies. Blair earned his bachelor’s degree in product design from Stanford University.

As Head of Advanced Analytics, Blair is focused on using Hum’s unique data and recent advances in AI to bring transparency, speed, and intelligence to the capital markets. In essence, building the tools he wished he had as a venture capitalist. In this Q&A, Blair shares his journey from investor to founder, how Hum’s platform is transforming diligence and post-deal monitoring, and what long-term success looks like for Hum’s data-first approach to private market financing.

Q Blair, what inspired you to start Hum Capital?

A Two things really – I’ve been founding and investing in companies since I was 12 and always think about Hum from both the company’s and investor’s perspectives.

As a company, you NEVER get good feedback. The amount of time I have spent as a founder trying to decipher what an investor was really thinking about me and why they didn’t invest is enormous and that’s AFTER being a venture capitalist! Imagine a world where companies know what investors are going to say about their businesses before they ask for a meeting. That’s the world Hum is building for companies.

As an investor, you spend hours with a private company to earn their trust and hear their story before you get your hands on the data that will tell you whether the company you are courting is fundable. Investment bankers make the problem worse because they’re spinning a story. Imagine a world where opportunities are pre-screened by a trusted 3rd party so that investors know they will invest and can talk terms with the company on the first meeting. That’s the world we’re building for investors.

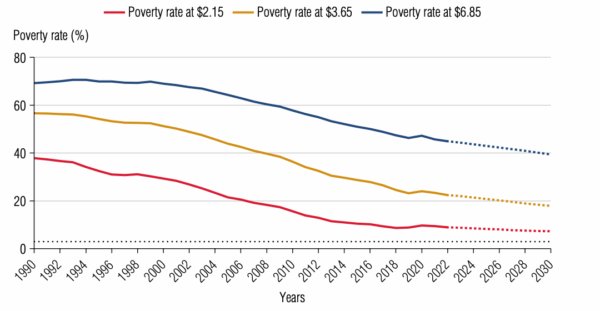

Both sides gain tremendous efficiency, can pour their brain-power into smart capital allocation (instead of courting) and society benefits through far more rapid wealth accumulation which, in turn, can be distributed to those in our world who need it most.

Source: World Bank, “Poverty, Prosperity, and Planet Report 2024,” Figure 0.1.

Q Hum just turned six. What do you consider our biggest accomplishments so far?

A It’s been a wild ride. We’ve built a profitable business, worked with thousands of companies and raised approximately $600M in balance sheet capital and $65M in equity. At the same time, it feels like it’s taken a lot longer than we thought it would to get to where we are and in many ways it feels like we are just getting started.

I think in these still early innings, the thing I’m most proud of is proving to ourselves that private market investing is entirely automat-able and that achieving the world I described above is about continuing to execute on our foundation rather than hoping for a technical breakthrough that doesn’t already exist. Investing is a tricky problem to automate because of the high levels of reliability required when making decisions to part with hundreds of millions of dollars or more in capital. Unfortunately, LLMs on their own are far from making a dent in this problem.

In fact, to get to a place where this problem is even automat-able has required many years of working with companies, diligently structuring data and carefully handcrafting metrics, schemas and systems to house the data that both the most thoughtful investors and CFOs consider when making investment decisions or allocating their capital.

Additionally, to access the data required to achieve meaningful automation you actually have to be a practitioner with a 5+ track record of achieving exceptional investment returns. Without this, no matter how effective your AI is, institutional capital won’t trust it to allocate their capital and companies remain behind layers of fees when accessing capital that they should be able to access directly.

In hindsight it makes sense to me why six years in I feel like we’re still in the early innings. And to be fair, the people whose experience I valued most in data businesses told me as we were getting started that things wouldn’t get interesting until we were 10 years in – and they were right (shout out to Wayne Goldstein and Saurabh Khemka)! My 30 year old self just didn’t know how to hear this. I had a 2 year old, plenty of venture capital on board and a clear vision for where we wanted to go. But building a data and operational fortress in the financial markets is a multi-decade journey and we’re fortunate to be positioned with systems and data to take rapid advantage of the background opportunities that AI present.

Q You recently transitioned to Head of Advanced Analytics. What are you focused on in this new role?

A As a founder, you always want to allocate your time to the areas you can uniquely help your business in. At Hum this is infusing our system with deep investing experience. I’ve been investing since I was 12 and spent time in credit and equity across both public and private markets. I also LOVE listening to investors and read annual reports from investors and companies for fun. Working with our investors (internal and external) to translate this experience into code is something I felt like I never had enough time to do as CEO and I tried for many years to find the right person to run Hum so I could focus on this problem. I was very fortunate to find Andrew Eisen first when he invested in Hum as an executive at S&P Global and then later when he came on board to Hum full time! And one year in, he is CRUSHING IT!

Q Why is that analytics layer so important right now?

A At about the 5 year mark, I felt that we had accumulated enough data to derive meaningful insights, both about investment strategies and the broader economy, from performance data companies trust us with and the details they share with us about the capital they already have. As I watched the results of our data science team bear fruit, I felt now was the time to establish a new team entirely dedicated to pushing Hum’s analytical capacities to the limit.

This is an exciting moment because it means we have actually created enough data to be dangerous in a space where the only other institutions with the level of data we have accumulated on private companies don’t have meaningful R&D budgets or already-scaled software systems that create investment analytics. Our engineering team has also done a great job of laying an extensive foundation for experimentation with that data. Much like public market oriented firms like TwoSigma and Bridgewater have extensive systems and data resources, Hum’s engineering team has put us in a similar position in the private markets. Now it is about refining our understanding of what the data is telling us and playing back our learnings to companies and investors so they can make better capital allocation decisions on our market than off. This is a very exciting and hands-on time for me and feels like the moment we have been building up toward over all these years!

Q What else do you want me to share with the reader?

A We are bringing a handful of exceptional people into our Advanced Analytics Group (AAG). Until Hum, I would have told you I wish I had been born in the 1970s so that I was coming out of college right as public market quantitative investors were taking off. I feel that the transformation the private markets will go through in the next decade on the back of general advances in AI and Hum’s toolkit will be bigger than the quant revolution for a few reasons. First, public companies may only share quarterly data. Private companies routinely share daily resolution data with us. Second, and because of this, brain power in the public markets has been focused on anticipating investor behavior and thus price movements. Imagine if this brain power had gone into figuring out how to allocate society’s capital with excellence? Because of the detailed, fundamental performance data that is common in the private markets, this vision is a reality now. If you are as excited about this opportunity as I am and have extensive experience making investments and writing code (in both Python and Rust), we at AAG would love to meet you :)