Hum Capital 2021 Year in Review

2021 has been an exceptional and exciting year at Hum Capital. We’ve grown our team and put together a dynamic executive leadership team, introduced our funding platform to the world, and closed our next round of funding — all in support of our continued mission of “connecting great companies with the right capital.” After two years of building our product, forming the right team, and adding valuable and strategic investors to support our vision, I couldn’t be more excited about where we are headed.

But, how did we get here? What did we accomplish? What have we done as a company to begin to transform fundraising in the private markets? I’m proud to recap our accomplishments, company milestones, and what’s next for Hum in 2022 and beyond. Let’s get humming!

Growing Our Team

In 2021 we welcomed 60 new members to the Hum team across sales, marketing, product, engineering, finance, you name it. This hiring across functional areas was pivotal for continued product innovation, scaling our go-to-market efforts, and forming internal processes and procedures.

Not only did we bolster those teams to help support the growth of Hum’s platform, but we expanded our executive leadership team to own these various functions. We welcomed:

- Scott Brown, Chief Marketing Officer

- Priscilla Gordon, VP HR

- Yotam Troim, Chief Product Officer

- Basile Senesi, Chief Revenue Officer

- Chris Dolezalek (CD), EVP of Research & Development

- Chipp Norcross, COO

As we enter the new year, I am excited to have a team of savvy experts and industry veterans with the relevant skills and experience to help us scale.

As we continue to grapple with the pandemic and the “new normal,” maintaining a strong, spirited, and supportive company culture has been challenging. I’m thankful to our team for all the hard work they’ve done to sustain a culture that any CEO would be proud of.

How have we done this? Here are a few examples below:

- Bi-weekly company all-hands meeting

- Monthly virtual happy hours to celebrate employee birthdays and work anniversaries

- Company Vision workshops

- In-person meetups to celebrate company milestones (in guidance with COVID-19 protocols)

- Monthly office hours – an AMA-style forum where employees come with questions, suggestions, and discuss improvements to our processes and products with our executive team

At Hum, we’re excited to continue these initiatives to create a supportive and transparent environment as we work together in pursuit of our company goals and mission.

Reinventing the Fundraising Process

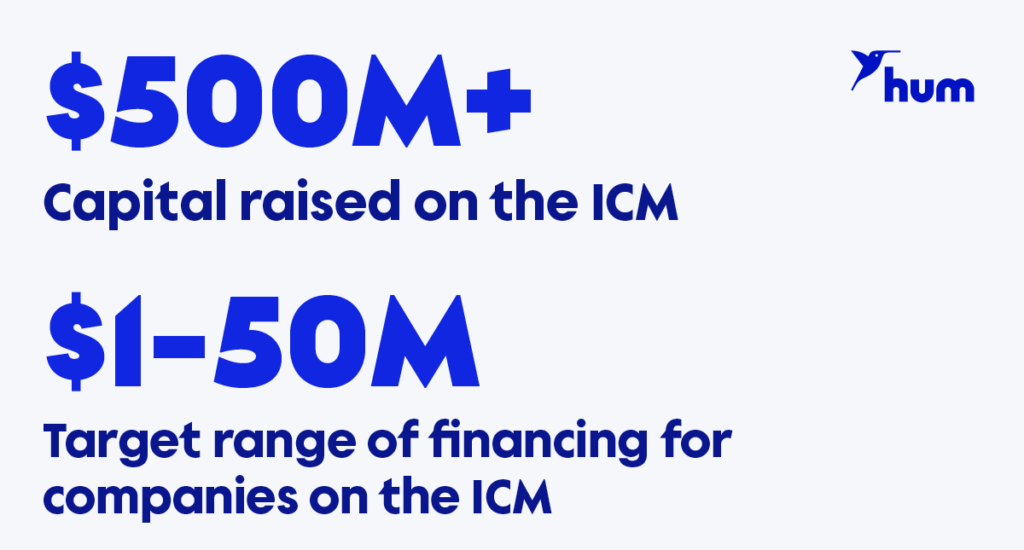

We set out to revolutionize the fundraising process, which is often found to be exclusive and inefficient. Our cloud-based funding platform, the Intelligent Capital Market (ICM), was launched in June to provide companies with a single destination to access capital from investors. Simply put, the ICM’s goal is to create a Kayak.com-like experience for institutional fundraising, thus making the process more efficient, transparent, and data-driven.

Today, with more than 70 percent of business applications being cloud-native and generating gigabytes of data daily, we are putting this data to use. The ICM works in 3 steps:

- Companies securely connect their data from 100+ business systems (ex: Quickbooks or Stripe) into the platform

- AI and machine learning tools label and analyze the data

- Our matching algorithm matches companies with a curated list of investors who meet their investment preferences

With the ICM, companies can understand all of their financing options and save time fundraising so they can focus on scaling their business. Investors get personalized deal flow delivered straight to their inbox.

Finally, I couldn’t end this section without touching upon our name change to Hum Capital. While our original name spoke to the fundamentals of the business, we have now built the go-to funding platform that facilitates matches between companies and investors based on real-time data rather than static information. Our ultimate goal is to get companies “humming” and successfully fundraise to achieve long-term success (the bird in our logo is named “Capi,” a homage to our original name, Capital Technologies).

Partnering with Influential Investors

After our initial successes connecting companies to investors with the launch of the Intelligent Capital Market, we began our own fundraise to accelerate our go-to-market efforts to bring even more companies and investors onto the platform. Aiming to rewire today’s fundraising process is both a hard technical and business problem to solve. We sought to partner with investors who took the time to understand the opportunity at hand and help guide us on our mission of connecting great companies with the right capital.

Towards the end of this year, we officially closed our $21M Series A round and I could not be more excited about the investors we have onboard. The investment was led by Steve Jurvetson’s Future Ventures with participation from tech VCs Webb Investment Network, Wavemaker Partners, and Partech Partners and institutional investors Cowen and Company, and Invesco Private Capital. Larry Wieseneck, Co-President of Cowen, has joined Hum’s board to help us bring data-driven insights and efficiencies to private investing.

We feel this is the right group of leading venture capital firms and private market investors that see where the future of private capital is headed. Their conviction in the ICM’s ability to bring a more scalable, data-driven approach to the $7 trillion private markets is a testament to Hum’s success so far in making funding equitable, efficient, and accessible.

Expanding Our Platform to Bring True Choice to Fundraising

Less than 6 months after we publicly launched the ICM to help companies secure non-dilutive financing, we secured our broker/dealer license to expand our services to support equity financing. Having access to both debt and equity options gives companies more choice when fundraising and advances our mission to become the go-to destination for great companies to connect with the right capital.

In addition to greater choice, offering both debt and equity provides companies the flexibility to raise some of both to optimize their total cost of capital and ownership dilution. This enhancement also allows us to attract a more diverse pool of investors and capital providers to the platform, equaling more options for companies when fundraising regardless of where they are located or what investor connections they might have. This helps reinforce our goal of removing bias in investing by analyzing a company’s performance data to showcase their financeability to investors.

By expanding Hum’s services to include equity, we’re empowering companies to navigate the private capital markets with a single portal, delivering on our mission to bring a Kayak-like experience to fundraising. If you or your company are interested in exploring your fundraising options contact us to connect with our investment team.

2022 and Beyond

At Hum, our vision is to create a world where potential is unconstrained by capital. Today, access to capital relies too much on personal connections. Companies should be evaluated on their business performance and growth potential not on who they went to college with or where they are headquartered. Hum and the Intelligent Capital Market are enabling companies to achieve their fullest potential.

I couldn’t be more excited about our potential and execution of our vision. As we enter 2022, stay tuned for more exciting company news, product updates, and events & resources on successfully financing your business.