Introducing SmartRaise – The Smarter, Streamlined Financing Option on Hum’s Intelligent Capital Market

At Hum Capital, our goal is to help companies and investors create greater choice and transparency in private market financings. That is why we’re excited to announce our new Hum Capital SmartRaise functionality on the Intelligent Capital Market (ICM)! This functionality creates an expedited financing option by matching a company’s financial profile with predefined deal criteria provided by participating SmartRaise investors. If there’s a match, companies receive preliminary funding terms in about one business day, removing weeks from the traditional fundraising process. Critically, this “smart” capital comes from leading institutional investors who are digitizing their time-tested investment processes via SmartRaise.

Our team could not be more excited about the ways we have seen our customers using SmartRaise during its beta period – here’s some additional information on the thinking behind the functionality, how it works within the ICM, and the unique value we see companies and investors creating with SmartRaise.

Why are we launching SmartRaise?

Identifying and selecting the right financing option can be challenging for companies raising private capital. Additionally, the fundraising process has proven to be inefficient – it takes too long and costs too much. We created SmartRaise to continue our mission of making the fundraising process more efficient, allowing companies to get back to running their business by quickly matching them with some of the smartest investors in the industry who have “plugged in” their specific deal criteria to identify the companies that best fit their funding parameters.

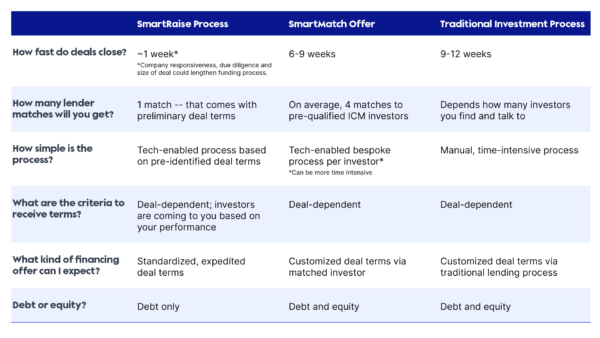

With SmartRaise, companies receive rapid and competitive preliminary financing terms enabling a quicker time to funding compared to the traditional process, which requires engaging multiple investors and negotiating terms with each investor individually. Because companies must connect their data to the ICM to get started, investors are receiving their most up to date, trusted performance data, allowing them to access an increased volume of qualified investment opportunities without needing to grow their originations teams. SmartRaise is bringing efficiency not only to companies, but to investors as well.

Private capital is increasingly becoming more and more data-driven as a greater number of companies host their data in cloud-accessible systems. SmartRaise is leading the way on this trend by offering qualifying companies with rules-based, data-driven preliminary funding terms almost immediately once a company connects their financial data.

Our doubling down on using companies’ performance data and metrics to drive investment decisions is not just because of the ongoing industry trend. At Hum we’re believers in company performance being the true identifier for how much companies can raise, not who you know or where you went to college. SmartRaise is not only providing companies with yet another financing option, but one that is aligned with their financial profile and growth needs.

How does SmartRaise work within Hum’s ICM?

SmartRaise is a more streamlined and efficient financing option for companies raising $1-50M in non-dilutive capital. Specifically, the functionality uses a rules-based decisioning to give companies preliminary funding terms based on their connected financial data in about one business day. From there, if a company accepts the terms and moves forward in the process, they can get funded in as little as a week (the typical debt transaction in a traditional financing process takes 8-12 weeks to close AFTER meeting with investors).

The preliminary funding terms and ultimate funding are made possible by participating SmartRaise investors who’s investment criteria is built into the ICM. SmartRaise is valuable to institutional investors because it enables them to leverage the ICM and the company performance data it collects, to programmatically invest private capital without having to dramatically grow their deal origination or investment/analyst teams.

Companies that do qualify for SmartRaise can choose to decline the preliminary terms and explore other options with the 350+ investors on the Intelligent Capital Market. Additionally, there is no cost to explore a Hum Capital SmartRaise offer.

SmartRaise vs. SmartMatch

With the launch of SmartRaise, we’ve now branded Hum’s more traditional approach to helping companies secure growth capital by introducing them to multiple investors simultaneously as SmartMatch.

What sets SmartRaise apart from the competition?

While SmartRaise offers a more streamlined, efficient process for companies fundraising, the true value of SmartRaise lies in the convenience of choice. What do we mean by that?

Today, companies have a few options beyond the traditional process when it comes to financing. However, not every lender, investor, or fintech funding platform offers the amount of choices that are available to you on the ICM. This lack of choice is an inconvenience, really, because seeking out other funding opportunities is a time-consuming process.

The SmartRaise process, on the other hand, is convenient simply because it’s like a common application that expedites access to some of the smartest institutional investors in the market who have digitized their traditional funding processes. Could you use Hum’s marketplace (via SmartMatch) to find a lower cost option? A faster option? Better terms? It’s possible, but you’ll pay the price in terms of time.

It all depends on what your business needs and how much time you and your team want to invest looking for it. If you don’t want to prioritize an exhaustive fundraising search, SmartRaise might be the right choice. But if you do, that’s okay. You can explore financing options with 350+ investors on the ICM—a choice we want our customers to feel empowered to make.

We are committed to streamlining the fundraising process from start to finish. With the addition of Hum Capital SmartRaise, companies can spend less time fundraising and more time focusing on what matters: running their business. To get started, sign up on the ICM and connect your financial data – and if you have any questions and want to speak to a member of our team, fill out the form here.