Reinventing the Financial Exchange for the Private Markets

When you think of a financial exchange, you probably think of NASDAQ or ICE Group. I bet you don’t, however, think about Goldman Sachs or alternative asset managers like Blackstone. But the way I see it, investment banks and asset managers are the exchanges of the private markets. Investors give them capital and they turn around and give that capital to companies, real estate projects, and more. These private asset managers handle upwards of $7 trillion of the estimated $430+ trillion of total global wealth and this number is growing rapidly.

Even a small percent of the private market AUM total is still big business. Why is so much of the world’s capital still going through a handful of businesses through a mostly human-centric workflow? Why aren’t we, as the global fintech community, reinventing the foundational institutions of a financial exchange?

The answer is that we are, or trying to, but we are in the early innings. LendingClub, for example, went public at $12B with the promise to serve as an intermediary between consumers and lenders. AngelList is one approach to create an exchange for startup equity. More players will enter this space to make the 2020s the golden era to reinvent the exchange business model. SaaS makes this shift possible. Here’s what that will look like—and why it will change the way the world does business, forever.

The Financial Exchange of the Future

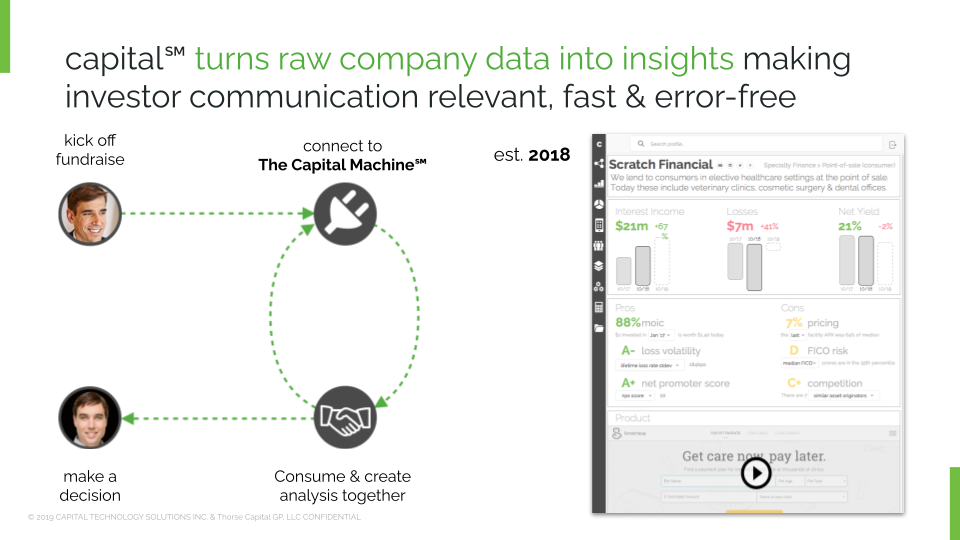

Companies will plug their data into an exchange. The exchange of the future will be part auditor, part analytics tool, and part marketplace. It starts by comparing system-of-record data to financial summaries (like the income statement). It flags anything that doesn’t reconcile so companies can make sure they pass the auditing step investors will eventually put them through. This will happen almost instantly and means data is trusted and has full provenance traceable back to the source. (Auditing is a $150B per year revenue business in the U.S. Moving auditing to the exchange saves months and potentially hundreds of billions of dollars.)

With audited, accurate data on board, companies can answer any quantifiable question they can imagine about their businesses—like what sales and marketing strategies have the best ROI, whether a debt or equity capital-raise makes more sense given their capital structure, or whether operating expenses are actually hiding cost of goods sold and inflating margins, etc. Analytics means full visibility—businesses can figure out exactly how they work and why. This in turn makes the exchange part VERY efficient.

A clearer picture of why a business works is exactly what company leadership needs to communicate with investors. It is all about education. Today, companies make pitch decks, investors ask questions, they iterate and iterate until both sides understand each other. This takes months and often both sides never fully understand each other. Within the exchange of the future, companies will simply allow data and analytics access to investors. Investors and companies will look at the data together to figure out whether a partnership makes sense. If a partnership comes to fruition, it will be grounded in data, removing any potential obstacles to focus on scaling the business.

If this all seems far fetched, it’s not. The 2020s are a unique moment in time, because 75% of businesses now run entirely in the cloud. That means that 3 out of 4 businesses can and do communicate how their business works from (fully auditable) source data—by simply provisioning access to systems of records. Companies already share system-of-record access to auditors who manually confirm that the way the business analyzes itself is correct. Auditors in turn share those reports with investors who use them to diligence potential investments.

Now there are details to perfect, of course—it doesn’t always make sure to share every data point, but the exchange of the future will have powerful permissioning which, by the way, means no more sensitive financials getting sent around between investors after a fundraising process is complete.

The Future of Private Financing

Back to investment banks and asset managers. In the private markets, financings take months. They often become full-time jobs for CEOs and CFOs. The exchange of the future could make financing frictionless—with the added benefit of returning 30-50% of executives’ time back to scaling their company.

There’s also the issue of bias. As hard as we may try, humans—including investors—have biases that are unhelpful in financial decision making. This is well known and I won’t dig into it here—just read “Thinking, Fast and Slow”—but the TL;DR is that sometimes those biases make raising or distributing capital unfair. This often means that if you have a great business but a mediocre Rolodex, raising capital will be difficult. It can also mean that if you are a person of color or a woman or don’t live in a major coastal financial hub, raising capital can be hard…or nearly impossible. Breaking the “club” built on bias is good for society at large and the exchange of the future will make this possible.

If this kind of transparent partnership becomes widespread, who knows how fast GDP could grow and how much faster the world will become a better place? Truth is, WE HAVE NO IDEA WHAT OUR CEILING IS as a society! SpaceX is within striking distance of sending humans to Mars, self-driving cars are on the streets of Phoenix and Shenzhen, but what more could be done if we invested in more groundbreaking ideas? If investors and companies can easily figure out the facts, understand each other, and together get 3-6 months back each year to build businesses (that is to say, sustainable solutions to complex social challenges), could our GDP grow at 4%? Or more?

The financial exchange of the future isn’t here yet, but I’m proud to be able to say that Hum Capital is part of building this future financing ecosystem. And not just because it’s an amazing network-effects business opportunity, but also because it’s about strengthening the bonds between people—that’s potentially quite good for the world, if not altogether revolutionary. It can kick start great businesses everywhere, run by people from all backgrounds. It’s an experiment worth running. And with huge demands to reimagine and reinvest in energy, food production, infrastructure and more, maybe this vision isn’t so crazy in 2021.