Building the Perfect Fundraising Data Room

In a recent post titled Right-Timing Your Fundraise, Wavemaker Partners’ Mikal Khoso described fundraising as telling a story illuminated by relevant metrics. Those metrics are consolidated in a fundraising data room. A natural next question for anyone raising capital should therefore be “What does the perfect data room look like?”

As Hum Capital’s Co-Founder, President, and a long-time venture investor, I’ve seen my share of fundraising data rooms. When you’re raising capital, how you present yourself matters and the data room is a big part of that. If everything is up-to-date and well-organized, your company looks like it has its act together.

Even if you see yourself and your company as disruptive forces, don’t try to disrupt expectations around the data room. During fundraising, where you’re trying to get people to trust you with millions of dollars, inventing a new data room structure is counterproductive. The data room should project a message of clockwork efficiency across the entire organization.

The data room should project a message of clockwork efficiency across the entire organization.”

For specifics on how to accomplish that, read on to learn what your data room should (and shouldn’t) contain, how many rooms you should have, and how you can manage the challenging process of keeping it updated.

What’s in the Data Room?

Non-specialty investors, whether VC firms or debt providers, may be willing to take a management meeting or two based solely on your company’s presentation, your compelling story, and the people involved in realizing the vision. As a next step, though, they will likely ask for data—a financial model, historical financials, and, ultimately, a vast amount of additional company detail as diligence progresses. For your data room, you should pull together the following documents in the formats noted below and keep them updated. (Thanks to Hum’s Head of Strategic Capital John Slater for creating this list!)

- Company presentation (your presentation on the business, possibly prepared by an advisory firm): PDF

- Company projections or company model: Excel

- Historic financials (i.e., profit & loss statement, balance sheet, cash flow statement): PDF or Excel

- Historic financial statements (i.e., profit & loss statement, balance sheet, cash flow statement) audited if possible: PDF

- Industry or company specific metrics or business Key Performance Indicators (KPIs) over time: Excel

- Relevant schedules depending on the business (list of stores, list of vessels, etc.): PDF

- Corporate entity organization chart: PDF

- Summary of equity cap table: Excel

- Schedule of debt or debt capital structure summary if debt plays a significant role in the cap structure: PDF or Excel

- Existing financing agreement documents including debt, loans, convertible notes, inventory financing, receivables financing, merchant cash advance, revenue-based financing facilities: PDFs

- Management and board bios (if not included in company presentation): PDF

- Key customer or supplier contract agreements: PDF

- Certificate of Incorporation and By-Laws: PDFs

EXCEPTION: The one exception to this list is a fintech specialty credit investor, who will likely want you to integrate directly into their platform. This type of investor may not care as much about many of these items because the basis for funding may be solely the size or nature of outstanding receivables, which would be run through the firm’s proprietary analytics. But unless you are pursuing this specific type of financing, you need to assemble the materials above.

A very early-stage company may not have all these items or may instead have pro forma financials rather than a history. Even so, it’s helpful to keep this list in mind as the company scales. Eventually you’ll have this information, and you will need to provide it.

Be aware, though, that the fundraising data room contents need to connect to the business story you’re telling. Remember that you’re raising money. You need to be transparent and truthful while also keeping your eye on the goal: disclose the information that will help you raise capital. So if something won’t help you, don’t lead with it. But be prepared to respond truthfully if someone asks about material you haven’t presented.

Two Data Rooms

Here’s a hard truth about fundraising: most investors will likely pass. It’s not necessarily a reflection on your company’s mission or value proposition—instead, there are dozens of other reasons. The investor specializing in your domain may be overwhelmed; they may have just invested in a competitor; the slice of the current fund dedicated to your vertical may be exhausted; your approach may not match the firm’s investment thesis. Therefore, you shouldn’t disclose all your data to every investor who expresses initial interest. But you also don’t want to disregard that potential interest. I recommend that you set up two fundraising data rooms: the mini data room and the full data room.

- The mini data room: You don’t share your entire life history on a dating site. Think about the mini data room in a similar way. The mini data room will qualify investors to access the full data room. In the mini data room, you should include your presentation deck, a mini vision deck, press clippings, the team’s bios, and a list of their achievements. With this basic material, potential investors can learn enough about your company to decide whether they want to continue their diligence.

- The full data room: Once your potential investors have considered the material in the mini data room and express further interest, have no conflicts in terms of portfolio or philosophy, and want to move forward in considering an investment, you grant them access to the full data room. This should contain all the relevant information from the earlier list. You should keep this information updated or within two days of easy work to update, regardless of whether you’re actively fundraising or not. I’ll elaborate more on this below.

The data rooms can serve both internal and external audiences. The mini data room, obviously, is for potential investors, likely to number about 50. But it can also be opened to executive-level recruits who want more information about the company. The only internal staff who should access the full data room are members of the fundraising team, which should be led by the CEO or founder. The CFO will also need access since they provide and manage the data.

When to Create your Data Room?

Since the data room supports your fundraising, you certainly want to have it ready when you start a process. Generally, a financing round, whether debt or equity, should sustain the company for about 18 months. The process should be kicked off, and your data room ready to go, six months before the anticipated process start date.

The process should be kicked off, and your data room ready to go, six months before the anticipated process start date.”

But as noted in the post about timing your fundraising, you should always be fundraising. Therefore, your data room should always be within 48 hours of presentation-ready, just in case someone contacts you and wants to learn more about the business.

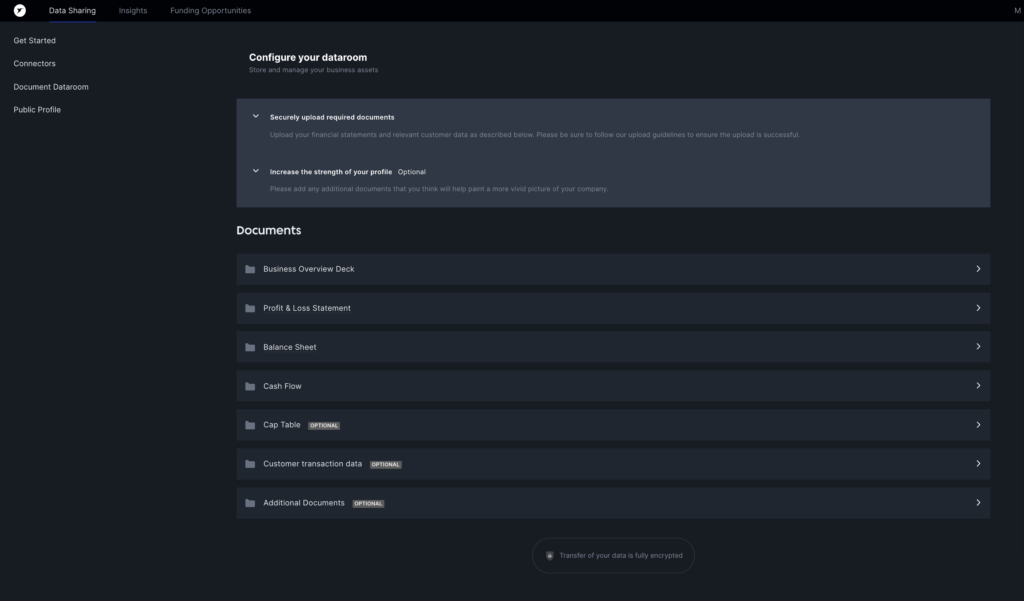

For many founders, the idea of trying to keep a data room continuously updated is daunting. That’s precisely why we at Hum designed the Intelligent Capital Market (ICM)—it addresses the need to easily update the data room and provides a platform to help companies fundraise more efficiently.

Instead of just placing relevant documents in a cloud-storage folder and calling that your data room, the ICM puts your data room in context, as one piece in telling your company’s entire story. In addition to hosting the data room with all the information described above, the ICM allows companies to connect their SaaS business systems, providing continuous updates of company performance. With this material, the team can quickly generate analytics that enhance an investor’s perspective of the business and help companies tell the best story for their fundraise.

With the ICM, you and your company have greater control and flexibility during fundraising. Investors can easily access your company’s performance data and relevant materials, creating greater efficiency during the diligence process.

Summary

An efficient and well-structured fundraising data room makes your company look professional and doesn’t waste your potential investors’ time as they think about the opportunity you present. Remember, everyone’s scarcest commodity is time. If your data room saves time—yours, your team’s, your potential investors’—you and your company will look efficient, organized, and financeable.

To learn more about Hum’s ICM and how it can help you wrangle your data rooms for your next fundraising, fill out this form to connect with our investment team.